Understanding the PFAS Ban Regulation

Latest developments in PFAS legislation - what does it mean for the industry?

Add bookmark

In 2024 and 2025, regulations surrounding per- and polyfluoroalkyl substances (PFAS) have significantly tightened across the EU, UK, and the U.S.. We're seeing a shift from initial discussions to actual restrictions and compliance requirements affecting automotive materials, such as seals, hoses, wire insulation, and coatings, as well as thermal systems, including refrigerants and elastomers.

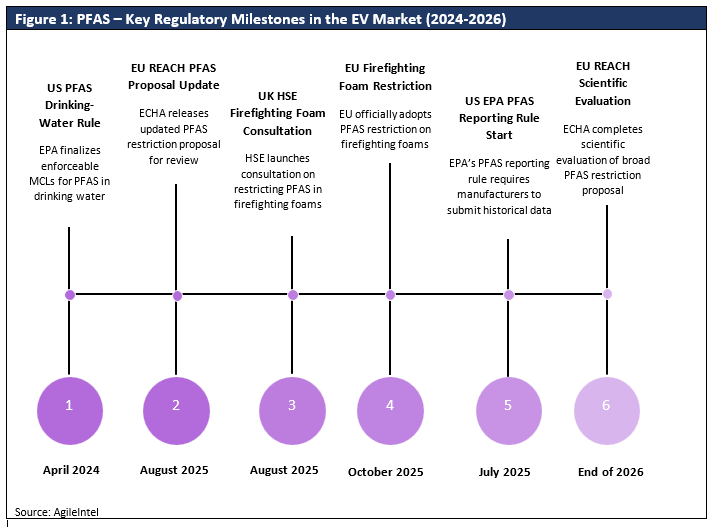

European Union (EU REACH): In the EU, the broad PFAS restriction proposal is currently undergoing scientific assessment at the European Chemicals Agency (ECHA). In August 2025, ECHA released an updated proposal outlining the review process, with a complete scientific evaluation expected to culminate by the end of 2026. After that, the Commission will be able to draft and implement a restriction, likely featuring multi-year transition periods and “essential use” exemptions for cases where safe alternatives aren’t available yet. Additionally, in October 2025, the EU officially adopted a PFAS restriction on firefighting foams, introducing stage-wise phase-outs - portable extinguishers will be phased out after 6 months, training/testing and municipal uses after 18 months, and specific high-risk industrial applications could take up to 10 years, this sets a clear precedent for how phased transitions might be handled for other PFAS applications.

United Kingdom (UK REACH): In the UK, the Health and Safety Executive (HSE) has made PFAS a priority in its 2023–2025 Rolling Action Plan. In August 2025, the HSE launched a consultation on restricting PFAS in firefighting foams, backed by an Annexe 15 restriction report. The HSE's plan also hints at further regulatory management options analyses (RMOAs) for broader PFAS groups, reflecting a similar trajectory to that of the EU.

U.S.: In the U.S., two federal initiatives are particularly relevant for automotive supply chains. The first is the PFAS drinking-water rule (NPDWR), finalised in April 2024, which sets enforceable maximum contaminant levels (MCLs) of 4 parts per trillion (ppt) for PFOA/PFOS and 10 ppt for Perfluorohexane sulfonic acid (PFHxS), Perfluorononanoic acid (PFNA), and Hexafluoropropylene oxide dimer acid (HFPO-DA/GenX). This rule employs a hazard-index approach for mixtures, leading to remediation obligations at industrial sites and utilities, which in turn affect permitting processes. Second, under the Toxic Substances Control Act (TSCA) Section 8(a)(7), the EPA's PFAS reporting rule requires manufacturers and importers to provide historical data on PFAS dating back to 2011. Although the start of the reporting period was pushed to July 2025, the rule's reach is extensive, now including automotive polymers, coatings, and electronics. Additionally, several U.S. states have implemented their own PFAS product restrictions, set to take effect in 2025, creating a complex web of additional responsibilities for components and after-sales products.

Why does this matter for the automotive industry?

The long-term clean-up costs for PFAS could soar past GBP1.6 trillion across the UK and EU over the next 20 years. This staggering figure highlights why regulators are moving towards class-based restrictions and why OEMs are hastening the transition to safer alternatives to minimise future liabilities. In the realm of powertrain and thermal systems, the immediate compliance challenges include:

a. Seals and hoses rich in fluoropolymers (like Fluoroelastomer Polymer Material (FKM/FPM) and Polytetrafluoroethylene (PTFE))

b. Insulation for wires and cables made from fluorinated polymers

c. Refrigerants and thermal fluids, where PFAS-related HFOs are under scrutiny, while natural refrigerants like CO₂ and propane are being prepared for use.

How are OEMs and Tier-1s are preparing for the upcoming PFAS restrictions?

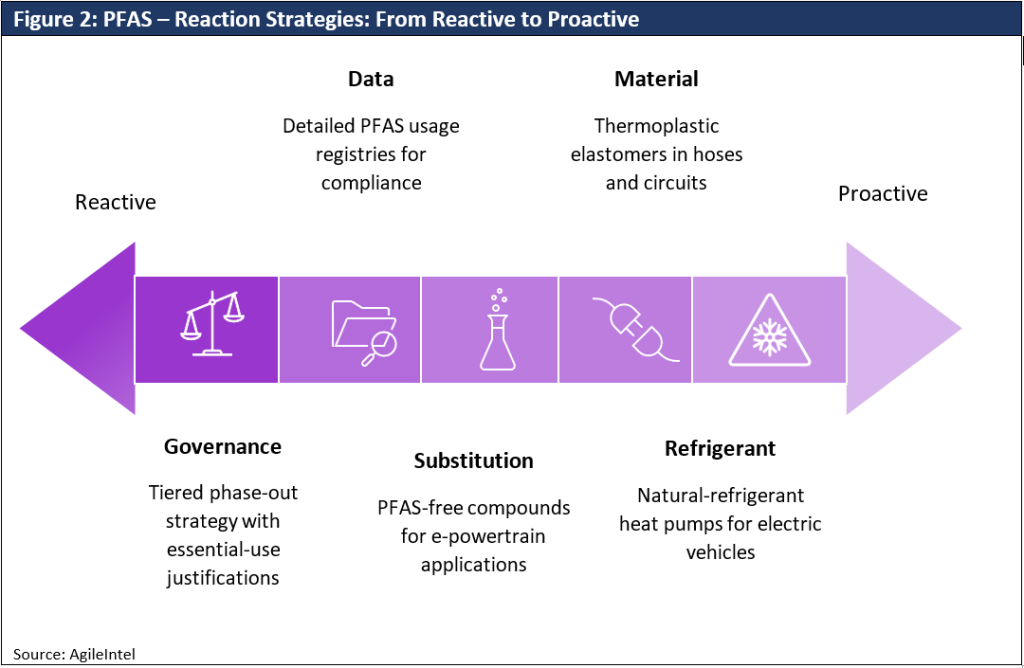

a. Substitution roadmaps for seals, gaskets, and housings are evolving - Leading sealing experts are rolling out PFAS-free or PFAS-reduced compounds designed explicitly for e-powertrain applications. For instance, in April 2025, Freudenberg unveiled a new sealing material that serves as a substitute for traditional PFAS-containing thermoplastics and FKM seals. This innovation focuses on enhancing battery safety and durability while adhering to stricter environmental regulations. However, industry guidance indicates that eliminating PFAS in a single step could compromise performance, so suppliers are prioritising the most critical applications first and providing justifications for essential uses when necessary. Additionally, sealing companies are promoting metal seals as PFAS-free options for certain high-temperature joints, ensuring durability and compliance in applications such as inverter housings and coolant manifolds.

b. Natural-refrigerant heat pumps and PFAS-light HVAC bills of materials - On the thermal side, major HVAC manufacturers are ramping up the development of CO₂ (R744) and propane (R290) heat pumps for electric vehicles. In February 2025, Valeo announced its commitment to developing these heat pumps in anticipation of PFAS bans in Europe, aiming to reduce reliance on PFAS-linked HFOs while enhancing efficiency in cold weather. This aligns with the growing adoption of R744 e-compressors across various European programmes, providing OEMs with a viable dual-refrigerant strategy as PFAS regulations take shape.

c. Data, disclosure and design-to-comply - The U.S. TSCA 8(a)(7) reporting requirements are pushing automotive manufacturers to create detailed PFAS usage registries that track everything from part and resin grades to chemical identities, volumes, applications, and worker exposure data dating back to 2011. Electronics and wiring suppliers are already guiding their customers on how to navigate supplier questionnaires and ensure material traceability, so that their bills of materials and safety data sheets can withstand regulatory scrutiny, capabilities that are becoming increasingly essential in today's compliance landscape.

d. Material and process innovation in hoses and thermal circuits - Companies are moving away from PFAS in hoses by opting for thermoplastic elastomers (TPEs) or hybrid designs when the duty cycles allow it. This shift not only reduces weight and costs but also enhances recyclability. For instance, Continental’s thermoplastic hose concept, designed for EV thermal circuits, offers a clear example of where the industry is headed—lightweight, compact, and cost-effective —and proves that there are alternatives that can deliver on performance while minimising PFAS exposure in cooling systems.

e. Governance, essential-use justifications and phased targets - Given that PFAS encompasses over 10,000 substances, most OEMs are implementing a tiered phase-out strategy. First, they’re removing PFAS from non-critical applications and then conducting substitution trials and validations for critical seals and high-voltage insulation. Finally, they’re preparing essential-use dossiers as needed, with a re-evaluation set to align with ECHA’s 2026 timeline. Formal technical documents submitted by automotive and chemical industry associations to the ECHA also stress the importance of differentiating high-molecular-weight fluoropolymers, such as PTFE, from more mobile PFAS in risk management, anticipating tailored measures that are likely to emerge in the final EU restrictions.

Overview of next-generation refrigerants compliant with emerging PFAS rules

As the EU and UK tighten PFAS restrictions and the U.S. ramps up reporting, OEMs are shifting towards non-PFAS, ultra-low global warming potential (GWP) refrigerants for heat pumps and integrated thermal modules. Two leading contenders have emerged for automotive use. These are:

CO₂ (R744, A1/non-flammable) - R744 completely sidesteps PFAS issues, boasts a Global Warming Potential (GWP) of 1, and performs exceptionally well in cold climates (it has higher discharge pressures but maintains impressive heat-pump efficiency even in sub-zero temperatures). Volkswagen has successfully implemented R744 heat pumps on a large scale in their MEB vehicles, with recent market updates confirming widespread adoption and supply from Hanon Systems. Hanon has reported shipping over 1 million R744 e-compressors by September 2025, indicating that the supply chain and service expertise are evolving. In cold-weather tests, R744 systems continue to operate as heat pumps below −10 °C. In contrast, Tetrafluoroprop-1-ene (R1234yf) systems often switch to energy-hungry Positive Temperature Coefficient (PTC) heating, highlighting the advantages of CO₂ in winter conditions.

Propane (R290, A3/flammable) - R290 is free of PFAS, has a GWP of about 3, is cost-effective, and offers excellent thermodynamic performance. Recent automotive research and conference papers have introduced indirect or secondary-loop EV heat pumps that keep the flammable charge contained within a compact, sealed module, transferring heat through coolant to the battery, power electronics, and cabin. This design is specifically tailored to meet safety and charging constraints. Several suppliers recently showcased propane-based thermal management modules at the International Automobile Exhibition (IAA) Mobility 2025, indicating a clear industry direction towards series-ready designs as standards and in-vehicle safety concepts are finalised.