EV/HEV Powertrain Market Overview

Key Insights, Industry Trends and Implications | 2026 - 2030

Add bookmark

Market Overview and Key Insights

The global automotive electric powertrain market is projected to reach US$715.9 billion by 2026 and US$1.78 trillion by 2031, with a 20% compound annual growth rate (CAGR). Key segments such as e-motors, power electronics, and thermal management systems are poised for substantial growth. For instance, e-motors are projected to rise from US$16.8 billion to US$25.2 billion, while thermal management systems are anticipated to surpass US$109 billion by 2031. This growth is fuelled by the swift adoption of 800 V architectures, silicon carbide (SiC) inverters, and integrated e-axle platforms, all of which boost power efficiency and facilitate ultra-fast charging. Innovative systems such as Hyundai’s E-GMP, BYD’s 8-in-1 platform, and Porsche’s Taycan are leading the charge, achieving 5-8% improvements in drivetrain efficiency and cutting charging times by 20%.

Additionally, heat-pump technology is gaining traction, offering up to a 20% increase in range in colder climates. These advancements highlight a growing synergy between electrification, thermal optimisation, and system integration in the electric vehicle sector.

Industry Trends: 2026–2030 Outlook

From 2026 onwards, the electric vehicle (EV) industry is set to shift towards a more integrated approach, moving away from separate sub-systems in favour of all-in-one e-axles, modular designs, and unified “power domains.” This new design strategy is expected to cut costs by as much as 30% compared to platforms from 2019, thanks to standardisation and modularity. The next wave of inverters and onboard chargers will likely be dominated by wide-bandgap materials like SiC and gallium nitride (GaN), which can reduce power losses by over 20% while boosting power density. At the same time, innovations in thermal management are transforming vehicle design: integrated thermal management systems and CO₂-based heat pumps can lower heating, ventilation, and air conditioning (HVAC) energy consumption by up to 38% at -7°C, helping to extend range in colder climates.

There’s also a growing focus on magnet-free and ferrite-assisted motor technologies to lessen reliance on rare-earth materials, with companies like Renault and Valeo aiming for 200 kW magnet-free e-motors by 2027. On the software side, manufacturers are leveraging predictive thermal control and over-the-air (OTA) updates to achieve 8–10% without requiring hardware changes. Additionally, the push for regionalised supply chains is gaining momentum, bolstered by initiatives such as the EU Critical Raw Materials Act, which aims to achieve 40% local processing and 25% recycling of essential materials by 2030.

Compliance and Regulatory Developments

Compliance has become a crucial element in the design of powertrains and the sourcing of materials. Regulations surrounding PFAS (per- and polyfluoroalkyl substances) have tightened significantly in major automotive markets. In the European Union (EU), the ongoing Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) review is expected to result in a comprehensive PFAS restriction by late 2026, with multi-year transition phases and “essential use” exemptions. The UK Health and Safety Executive (HSE) launched consultations in August 2025 on restricting PFAS in firefighting foams, setting the stage for broader limitations on elastomers, seals, and coatings. In the U.S., the Environmental Protection Agency’s (EPA) PFAS reporting rule under the Toxic Substances Control Act (TSCA) Section 8(a)(7) mandates that manufacturers provide PFAS data going back to 2011, while the new National Primary Drinking Water Regulation (NPDWR) limits establish contamination thresholds as low as four ppt for key PFAS compounds. This has a direct and profound impact on the design of refrigerant loops, seals, and insulation materials.

On the trade side, new tariffs and export controls are altering the cost structure of EV powertrains. The U.S. Section 301 tariff will impose a 25% duty on Chinese permanent magnets starting in January 2026, while the EU’s anti-subsidy regulation will impose duties ranging from 35% to 45% on Chinese battery electric vehicles (BEVs), promoting the localised production of e-axles and power electronics. Meanwhile, China has tightened its regulations and increased licensing requirements, and Brazil is set to reinstate a 35% EV import tariff by 2027. All these regulatory changes highlight the urgent need for localised, compliant, and PFAS-free value chains.

Implications for Automotive Companies

The automotive industry is undergoing a significant transformation, driven by the interplay of technological advancements, compliance requirements, and trade restrictions. Original equipment manufacturers (OEMs) and Tier-1 suppliers now face mounting pressure to strike a balance between cost and innovation, pushing them towards adopting standardised, modular designs that simplify parts and enhance production efficiency. As tariff barriers and shortages of essential materials disrupt global supply chains, forming regional partnerships like the Stellantis-Nidec EMOTORS joint venture has become crucial for ensuring a steady supply of components and reducing risks.

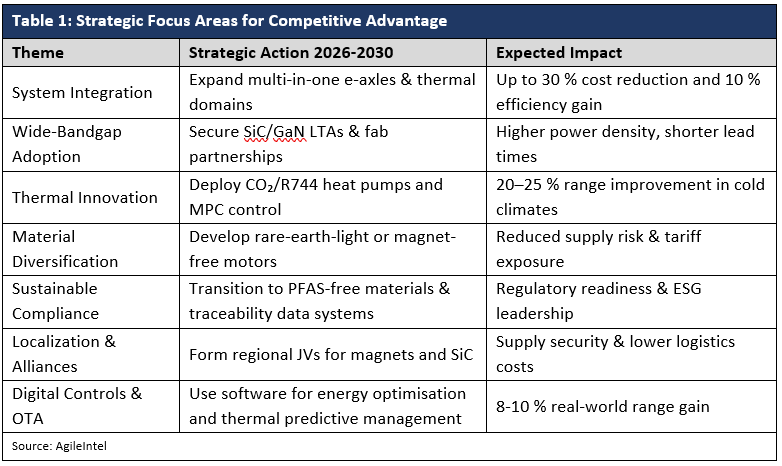

Strategic Focus Areas for Competitive Advantage

Additionally, compliance has shifted from just a box to check off to a key factor that sets companies apart. In the current scenario, having PFAS-free thermal systems, traceable material sourcing, and robust sustainability reporting is essential for gaining a competitive edge. To navigate this complex environment successfully, automakers need to diversify their technology offerings by adopting strategies such as retaining magnet-based systems for high-end models while creating magnet-free options for mass-market vehicles and establishing digital material registries that comply with TSCA and the European Chemicals Agency (ECHA) traceability standards.

Extended Outlook - 2030 and Beyond

As we look toward 2030 and beyond, the future of powertrains is set to be shaped by a blend of high-voltage electrification, eco-friendly materials, and intelligent AI optimisation. The industry is anticipated to see 800–1200 V SiC and GaN architectures become the norm, delivering higher power density and faster charging times. PFAS-free refrigerants like R744 (CO₂) and R290 (propane) are also on track to replace fluorinated compounds in HVAC and thermal systems.

By the end of the decade, regional magnet manufacturing and wide-bandgap semiconductor production are projected to satisfy at least 40% of domestic demand in North America and Europe. Additionally, software-defined powertrains will seamlessly integrate drive, thermal, and energy management systems using intelligent algorithms, enhancing efficiency and prolonging battery life. The balance between hardware standardisation, software flexibility, and sustainable materials will ultimately decide the industry's long-term leaders, with companies that focus on compliance, circularity, and digital innovation poised to drive the next wave of competitiveness.

Want to find out more? Attend our EV/HEV Powertrain 2026 event in Germany on 24th-26th February. Find out more here.