The automotive industry had its fair share of attention-grabbing headlines in 2019.

From President Trump’s trade wars with the EU and China to the on-going power struggle at Renault Nissan, there were times that journalists were spoilt for choice when deciding what story to cover.

However, in amongst this glut of news a few stories emerged that are likely to spill over into 2020, and possibly even go down in the annals of history as moments that changed the industry forever.

Many of these news stories covered events brought about by the disruptive effects of Connected, Autonomous, Shared, Electrified (CASE) mobility that is increasingly influencing the course that the industry is charting.

This was particularly well illustrated by the many headlines spawned by developments in electrification, where the industry experienced significant upheaval as the technology showed signs of gaining traction.

Tesla’s time to shine

After years of negative criticism centered around Tesla’s business model and sustainability, the little company headquartered in California set several milestones that not only catapulted the young OEM into the record books but also, for the first time, proved the long-term viability of the EV in the future of mobility.

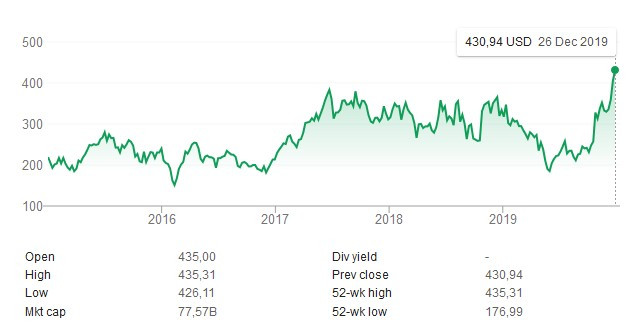

During the past six months Tesla’s shares appreciated more than 85 percent which, if it was included, would qualify it as the best performer in the S&P 500. It also came in first out of 38 companies in the Bloomberg Intelligence Global Automobile Index.

Not only did the firm cement its position as the most valuable American motor manufacturer by market capitalization, but in Q3 it leapfrogged Daimler to become the third most valuable automotive OEM globally. With a record share price of over $430 and a market cap of approximately $77.5bn, Tesla has increased its shareholder value by 1,190 percent since 2010, while the industry appreciated by 158 percent over the same period according to data compiled by Bloomberg.

Achieved on the back of increasing production and sales volumes that hit an all-time record of 367,500 global deliveries, the timeous completion of the Chinese Gigafactory and the selection of Berlin as the future European home to Tesla, the company finally proved its worth as a global player.

Moreover, having grown tenfold since 2014, Tesla’s revenue is predicted to increase a further 21 percent in 2020 and 18 percent in 2021, according to 27 analysts contributing to Bloomberg’s forecast. In contrast, over the same periods the average growth for the 10 largest automakers is expected to be 1, 4 and 3 percent respectively.

While Tesla has survived the growing pains of establishing itself as a leader in the EV market and is now beginning to reap the rewards as a successful early adopter, other legacy OEMs are seeing their profits tumble as R&D costs of CASE and stagnant sales take their toll.

McKinsey’s Center for Future Mobility estimates that securing a strong position across all four areas of CASE would cost a manufacturer an estimated $70bn through 2030 – which is more than the market capitalization of all but the top three OEMs.

It’s doubtful any individual organization could shoulder this level of investment independently, which is why the industry is turning to alliances and mergers that a few years ago would have been unthinkable. Sergio Marchionne found this out after his “Confessions of a Capital Junkie” presentation, advocating industry collaboration in 2015, drew no interest.

PSA group and FCA tie the knot

Viewed by many as the most dramatic sign yet that the industry is under severe pressure to respond to the increasing demands of new technologies, the merger of Groupe PSA of France and Fiat Chrysler Automobiles is the largest transaction involving two automakers since the takeover of Chrysler by Daimler over two decades ago.

As the mobility landscape evolves and organizations cut costs to free up budget for capital intensive CASE technologies and forays into emerging markets, the merger remains an attractive strategy to achieving these corporate objectives.

In the instance of the PSA/ FCA union the two parties expect to realize $4.1bn in yearly cost savings without plant closures. Taxed, capitalized and adjusted for the cost and time the savings will take to materialize, these could be worth about $4.4bn to each partner.

However, forging a new entity that can successfully leverage the cost savings that come from sharing R&D expenses and platforms, and economies of scale, may still not be enough to guarantee an alliance’s sustainability.

The enormity of the task can, for instance, be gauged by the fact that while PSA and FCA sold a collective 8.7 million vehicles last year, the combined installed manufacturing capacity stands at 14 million vehicles, according to an estimate by LMC Automotive. In other words, way short of the conservative profitability benchmark of 80 percent utilization.

To put this figure in perspective, in order to achieve 80 percent manufacturing utilization, the new entity would have to increase production and sales by 2.5-million units.

While there are obvious opportunities to rationalize production and model platforms in both Europe and North America, these markets show little signs of growth, and even though both companies have significant room for improvement in China it is unlikely that within the near to medium term this will be possible.

Which then leaves CEO-elect Carlos Tavares with another challenge: Does he shutter production facilities, possibly even spinning off Alfa Romeo? Both of which would be contrary to the promises made to labor and investors.

Greater than the sum of their parts

While the merger may be an appropriate response to the pressure of CASE for some manufacturers, others, such as Ford and Volkswagen are turning to collaboration and the joint venture as a solution.

Often criticized for lagging other OEMs in the development of new technologies, Ford has chosen to rectify this by partnering with – or even purchasing shares in – startups and technology leaders that show promise.

Volkswagen is one such company that is intent on becoming the leader in producing affordable yet profitable EVs for the masses, based on its flexible and scalable MEB platform.

While Tesla has proven that EVs in the luxury segment of the market are viable, VW aims to reinvent the people’s car as an EV for the 21st century. In what could become another historical event the first of these electric people’s cars, the ID3, went into production in November in Zwickau, Germany.

What’s more, through a collaborative agreement, Ford will gain access to the same platform to produce over 600,000 MEB-based vehicles in Europe over a six-year period starting in 2023.

Although the Ford EV will be designed and developed at Ford's development center in Merkenich near Cologne, up-front development costs will be slashed by using the modular MEB. Volkswagen on the other hand could rake in up to $20bn in revenue by supplying MEB parts and components, while at the same time leveraging the economies of scale to reduce costs.

Further benefits will be extracted from the alliance by boosting resources and investment in self-driving specialist Argo AI, in which Ford currently holds the majority stake. This will come in the form of a $2.6bn investment by VW, with Ford injecting the remaining $600million of its previously announced $1bn cash commitment into the venture. What is more the deal will increase the alliance’s global skills base to over 700 personnel.

However, despite the lofty objectives of the plethora of alliances and mergers setup to meet the challenges of the rapidly evolving mobility landscape, not all prove to be profitable or even viable.

BMW and Daimler call it quits on car sharing in North America

Touted by many to be the end game in mobility, car sharing took a series of knocks in 2019 that dramatically illustrate the unresolved challenges faced by the business model.

The latest – and possibly the most significant – of these came in late December when one of the largest companies, the recently merged BMW/Daimler business ShareNow, announced that it would be withdrawing completely from North America and end operations in London, Brussels and Florence, effective February 29, 2020.

While ShareNow might be the latest car sharing casualty, it isn’t the only project to have failed in 2019. Earlier in the year, GM announced that it was pulling its Maven service out of eight North American cities, with Chariot, the micro-transit service owned by Ford, also terminating operations in February.

This apparent collapse of the car sharing market in these regions would have been unthinkable five years ago. By the middle of the decade nearly every major automaker was developing an ambitious plan based on car sharing. However, today the focus has largely shifted to either ride hailing or car subscription models.

These few attention-grabbing stories that made the headlines in 2019 were selected as a representation of the relentless disruption the industry is undergoing, as well as the successes, challenges and potential solutions that are likely to drive the headlines deep into the next decade.